Setting up a payroll system is a critical task for any business, ensuring employees are paid accurately and on time while staying compliant with legal requirements.

A well-organized payroll process not only boosts employee satisfaction but also helps avoid costly penalties and fines. This guide will walk you through the steps to set up payroll for your business, covering essential aspects from choosing a payroll system to compliance with tax regulations.

Understanding Payroll

Payroll involves more than just issuing paychecks. It encompasses the entire process of compensating employees, including calculating wages, withholding taxes, and ensuring compliance with employment laws.

An efficient payroll system should automate calculations, generate accurate reports, and integrate seamlessly with your accounting system.

Steps to Set Up Payroll

1. Obtain an Employer Identification Number (EIN)

An EIN is required to report taxes and other documents to the IRS. You can apply for an EIN online through the IRS website. This number is crucial for identifying your business and handling payroll taxes.

2. Determine Your Payroll Schedule

Decide how often employees will be paid. Common payroll schedules include weekly, bi-weekly, semi-monthly, and monthly. Consistency is key to maintaining employee trust and satisfaction.

3. Choose a Payroll System

There are several options for managing payroll:

a. Manual Payroll

Suitable for very small businesses with a limited number of employees. However, it is time-consuming and prone to errors.

b. Payroll Software

Automates many aspects of payroll processing, reducing the risk of errors and saving time. Popular options include QuickBooks, Gusto, and ADP.

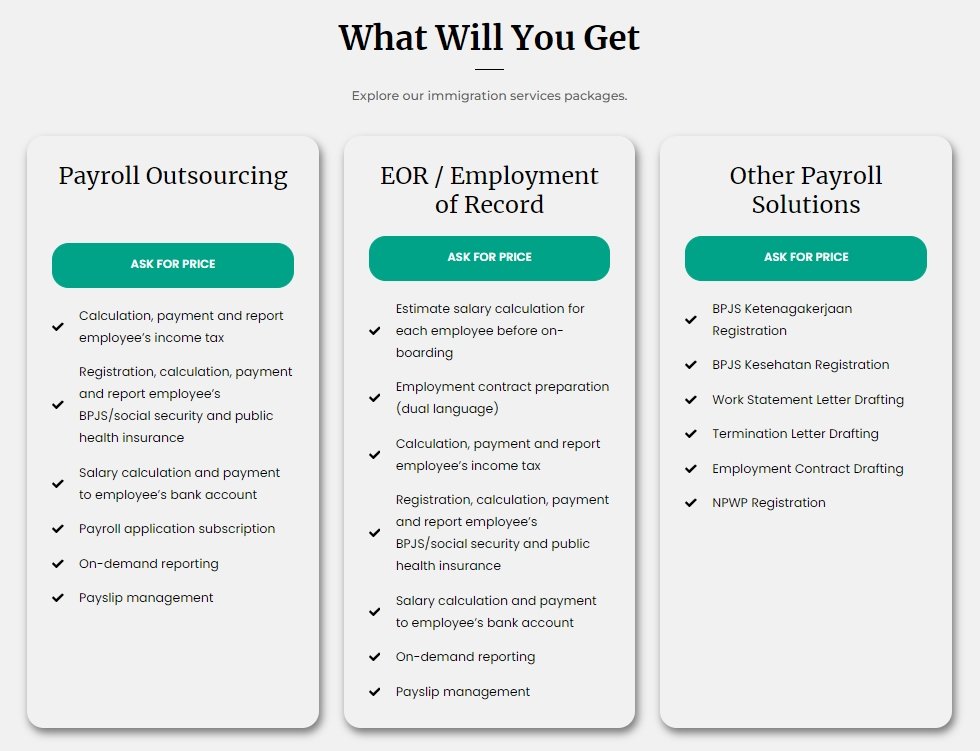

c. Outsourcing Payroll

Hiring a payroll service provider to handle all aspects of payroll processing can be beneficial for larger businesses or those without dedicated HR staff.

4. Classify Your Employees

Correctly classify workers as employees or independent contractors. Misclassification can result in penalties and back taxes. Employees typically receive benefits and are subject to tax withholding, while contractors are responsible for their own taxes.

5. Collect Employee Information

Gather necessary information from employees, including:

– Full name and address;

– Social Security number;

– W-4 form (Employee’s Withholding Certificate);

– Direct deposit information (if applicable);

– Benefits enrollment forms (e.g., health insurance, retirement plans).

6. Set Up Payroll Accounts

Create accounts for payroll expenses, taxes, and benefits in your accounting system. This helps in tracking and managing payroll-related transactions accurately.

7. Calculate Gross Pay

Gross pay is the total amount earned by an employee before deductions. Calculate based on hourly wages or salary, including overtime, bonuses, and commissions if applicable.

8. Determine Deductions

Identify all necessary deductions, including:

– Federal, state, and local taxes;

– Social Security and Medicare (FICA);

– Health insurance premiums;

– Retirement contributions (e.g., 401(k) plans);

– Wage garnishments or other court-ordered deductions.

9. Calculate Net Pay

Subtract all deductions from the gross pay to determine the net pay, which is the amount the employee takes home. Ensure accuracy to avoid issues with employee satisfaction and compliance.

10. Generate and Distribute Paychecks

Issue paychecks or direct deposits based on your chosen payroll schedule. Ensure employees have access to pay stubs detailing their earnings and deductions.

11. File Payroll Taxes

Calculate and remit payroll taxes to the appropriate federal, state, and local agencies. This includes:

– Federal income tax withholding;

– FICA taxes (Social Security and Medicare);

– Unemployment taxes (FUTA and state unemployment).

Use the IRS EFTPS (Electronic Federal Tax Payment System) for federal tax deposits and comply with state-specific filing requirements.

12. Maintain Payroll Records

Keep detailed records of all payroll transactions, including employee earnings, tax withholdings, and deductions. Federal law requires retaining payroll records for at least three years, while some states may have additional requirements.

13. Stay Informed About Payroll Regulations

Stay updated on changes in payroll laws and regulations, including minimum wage adjustments, tax rate changes, and new compliance requirements. Regularly review resources from the IRS, Department of Labor, and state agencies.

Tips for Efficient Payroll Management

1. Automate Where Possible

Utilize payroll software to automate calculations, tax filings, and direct deposits. Automation reduces the risk of errors and saves time.

2. Regularly Reconcile Payroll

Reconcile payroll accounts regularly to ensure accuracy and identify discrepancies early. This helps maintain financial integrity and prevents issues during audits.

3. Provide Employee Training

Educate employees on payroll processes, tax forms, and benefits enrollment. Clear communication reduces confusion and helps employees understand their compensation.

4. Seek Professional Help

Consider consulting with a payroll expert or accountant to ensure compliance and optimize your payroll processes. Professional guidance can help navigate complex regulations and avoid costly mistakes.

Setting up a payroll system is a critical step in managing a business effectively. By following the outlined steps, you can establish a reliable payroll process that ensures employees are paid accurately and on time, while also complying with all legal requirements.

View this post on Instagram

Whether you choose to manage payroll manually, use software, or outsource the function, maintaining accuracy and staying informed about regulations are key to successful payroll management.

A well-organized payroll system not only enhances employee satisfaction but also contributes to the overall financial health of your business.