Establishing a foreign company in Indonesia can be a lucrative opportunity, given the country’s strategic location, large consumer market, and growing economy. However, navigating the legal and bureaucratic processes can be challenging. This guide provides a detailed overview of the steps involved in setting up a foreign company in Indonesia.

Read Also How to Set Up a Company in Indonesia: A Step-by-Step Guide

Understanding the Legal Framework For Foreign Company

Before diving into the establishment process, it’s crucial to understand the legal framework governing foreign investments in Indonesia. The primary legislation includes the Investment Law (Law No. 25 of 2007), the Company Law (Law No. 40 of 2007), and the Negative Investment List, which outlines sectors restricted or closed to foreign investment.

Step 1. Choose the Right Business Structure

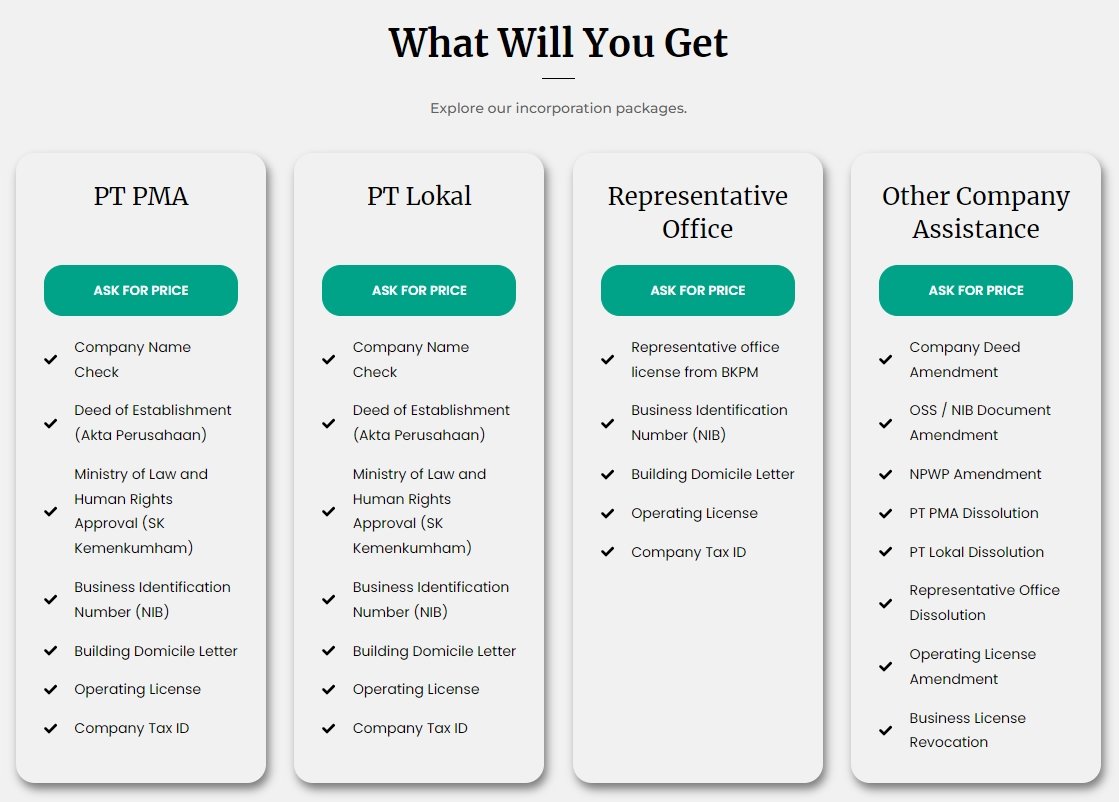

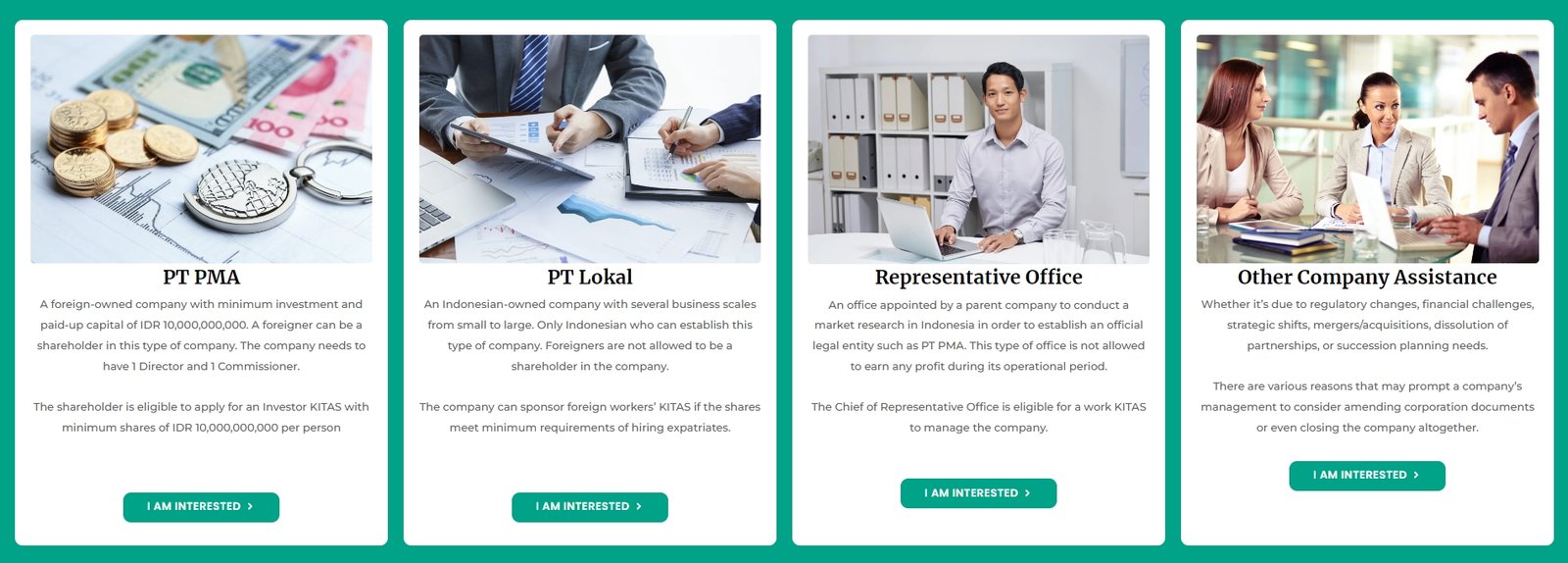

Foreign investors can choose from several business structures, each with its own advantages and requirements:

Representative Office (KPPA)

Suitable for market research and promotion activities but not allowed to conduct commercial transactions.

Foreign-owned Limited Liability Company (PT PMA)

The most common structure for foreign businesses, allowing full operational activities and profit-making.

Step 2. Fulfill Capital Requirements

For a PT PMA, the minimum capital requirement is IDR 10 billion (approximately USD 700,000). This includes the paid-up capital, which must be at least 25% of the total capital.

Step 3. Reserve a Company Name

The next step is to reserve a company name. The name must be unique, not resemble existing company names, and comply with Indonesian naming conventions. The reservation can be done online through the Ministry of Law and Human Rights website.

Step 4. Draft the Articles of Association

The Articles of Association (AOA) is a crucial document that outlines the company’s purpose, structure, and operating procedures. It must be drafted in Indonesian and notarized by a local notary.

Step 5: Obtain the Deed of Establishment

Once the AOA is notarized, the next step is to obtain the Deed of Establishment. This deed must be signed by all shareholders and notarized. It serves as the official proof of the company’s establishment.

Step 6. Apply for Legal Entity Status

To obtain legal entity status, the company must register with the Ministry of Law and Human Rights. This involves submitting the Deed of Establishment and other required documents. Once approved, the company will receive a legal entity certificate.

Step 7. Register with the Investment Coordinating Board (BKPM)

The BKPM is the primary government body overseeing foreign investments. The company must submit an investment application, including detailed information about the business activities, capital, and shareholders. Upon approval, the company will receive an Investment Registration (PI).

Read Also Limited Company: Understanding the Benefits and Responsibilities

Step 8. Obtain Business Licenses and Permits

Depending on the industry and business activities, the company may need to obtain additional licenses and permits. Common requirements include:

Business Identification Number (NIB)

Issued by the Online Single Submission (OSS) system, the NIB serves as the primary business license.

Sector-specific Licenses

Additional licenses may be required for regulated sectors such as finance, healthcare, and manufacturing.

Step 9. Register for Tax and Social Security

The company must register for a Tax Identification Number (NPWP) with the local tax office. Additionally, it must enroll in the social security programs for employees, including the Social Security Administrator for Health (BPJS Kesehatan) and the Social Security Administrator for Employment (BPJS Ketenagakerjaan).

Step 10. Open a Corporate Bank Account

A corporate bank account is essential for conducting business transactions. To open an account, the company must provide the bank with its legal entity certificate, tax registration, and other required documents.

Step 11. Hire Local Employees

Foreign companies are encouraged to hire local employees, as this supports the local economy and facilitates smoother operations. It is important to comply with Indonesian labor laws, including minimum wage requirements, employment contracts, and employee benefits.

Step 12. Comply with Reporting Requirements

Once operational, the company must comply with ongoing reporting requirements. This includes submitting annual financial statements, tax returns, and other regulatory filings. Failure to comply can result in penalties and legal issues.

Key Considerations and Challenges

Establishing a foreign company in Indonesia involves navigating several challenges:

1. Regulatory Complexity

The regulatory environment can be complex and subject to frequent changes. Staying informed and seeking legal advice is crucial.

2. Cultural Differences

Understanding and respecting local business culture and practices can facilitate smoother interactions with employees, customers, and government officials.

3. Local Partnerships

Forming partnerships with local businesses or consultants can provide valuable insights and support in navigating the business landscape.

Establishing a foreign company in Indonesia offers significant opportunities but requires careful planning and adherence to legal and regulatory requirements. By following the steps outlined in this guide and seeking professional advice when needed, foreign investors can successfully set up and operate their businesses in Indonesia.

View this post on Instagram

The country’s dynamic economy, strategic location, and large consumer market make it an attractive destination for foreign investment, promising substantial returns for those willing to navigate the establishment process.

Thank you for reading this article.

WeSrve provides business incorporation services that will help you to simplify your work tasks.

To learn more about our company and our services, visit our website or contact us through email: support@wesrve.co.id and WhatsApp.

We look forward to serving you and helping you achieve your goals.